IRS 8633 2003-2026 free printable template

Show details

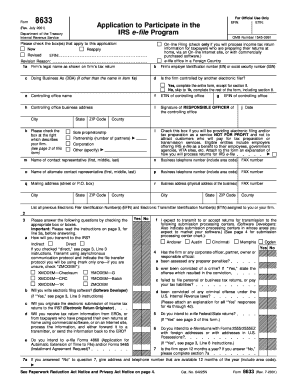

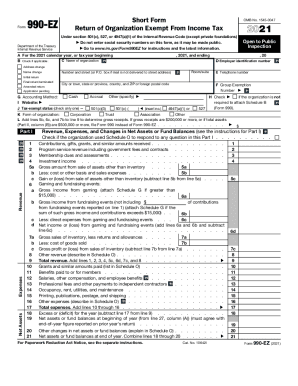

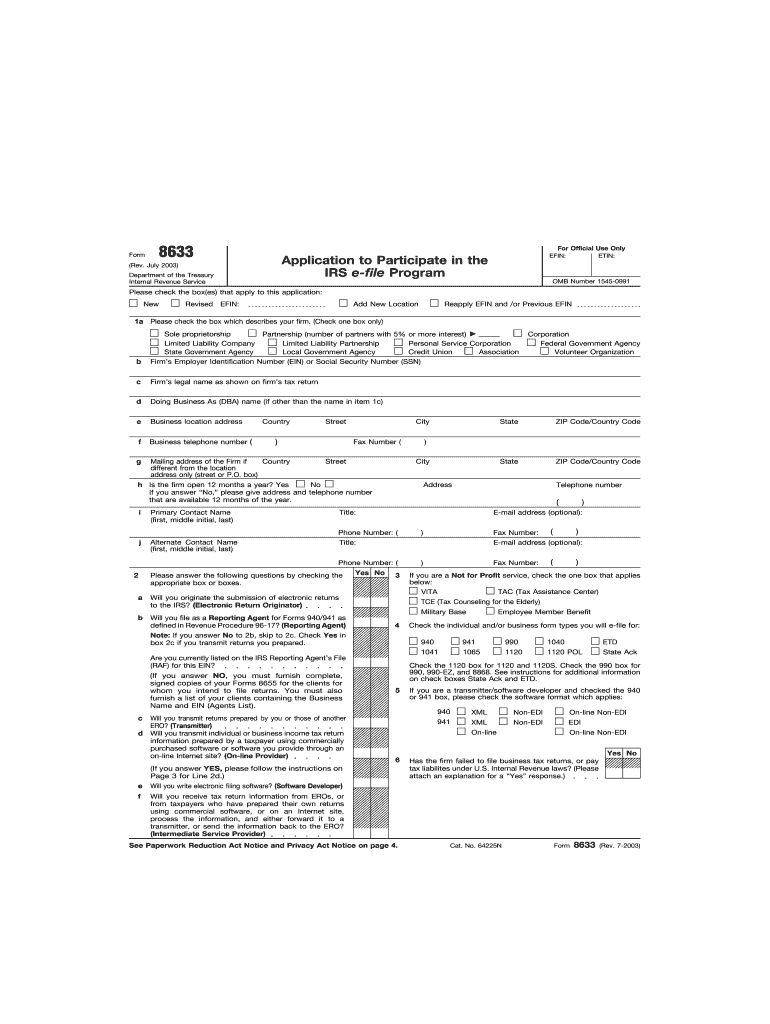

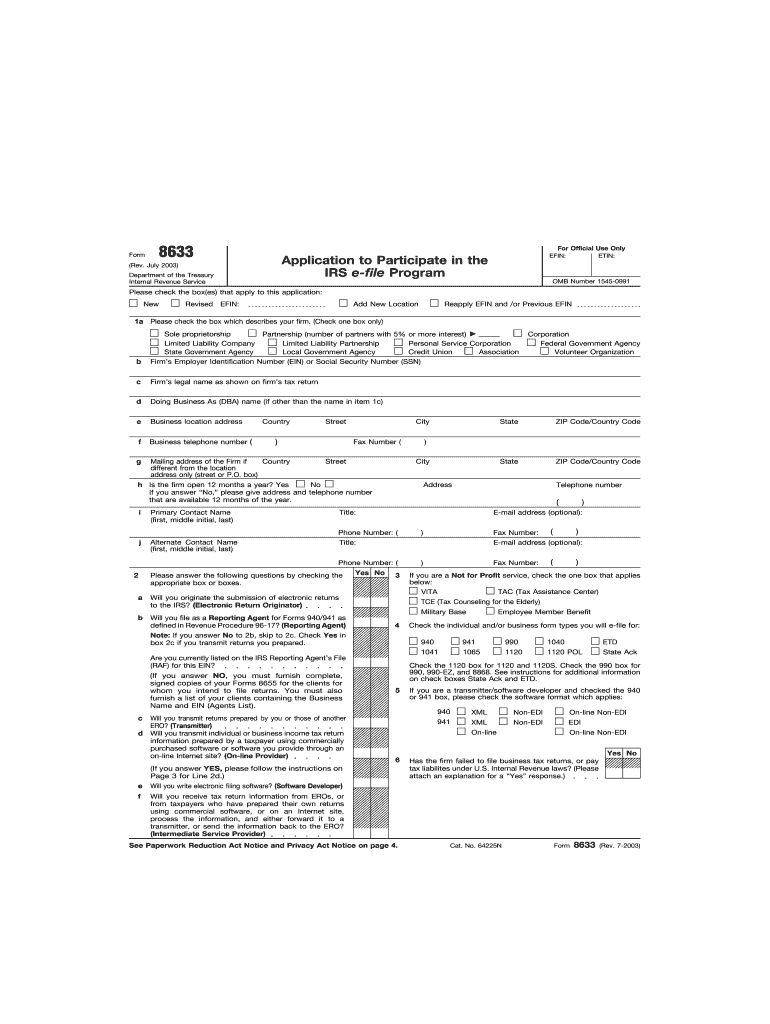

Form 8633 (Rev. July 2003) Department of the Treasury Internal Revenue Service Application to Participate in the IRS e-file Program Add New Location For Official Use Only ERIN: TIN: OMB Number 1545-0991

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8633

Edit your IRS 8633 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8633 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 8633 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS 8633. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8633 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8633

How to fill out IRS 8633

01

Obtain IRS Form 8633 from the IRS website or your local IRS office.

02

Provide your information in the applicant section, including your name, address, and phone number.

03

Indicate your entity type (individual, partnership, corporation, etc.) in the designated section.

04

Fill out your Employer Identification Number (EIN) if applicable, or indicate if you are applying for one.

05

Complete the sections regarding the type of application you are submitting.

06

Sign and date the form at the bottom.

07

Submit the form via fax or mail as instructed in the guidelines.

Who needs IRS 8633?

01

Tax professionals who want to become authorized e-file providers.

02

Businesses that require authorization to file tax returns electronically.

03

Individuals seeking to facilitate e-filing for clients and customers.

Fill

form

: Try Risk Free

People Also Ask about

How early can I file my taxes?

Even though taxes for most are due by April 18, 2022, you can e-file (electronically file) your taxes earlier. The IRS likely will begin accepting electronic returns anywhere between Jan. 15 and Feb. 1, 2022, when taxpayers should have received their last paychecks of the 2021 fiscal year.

What happens if I don't file taxes?

We calculate the Failure to File Penalty in this way: The Failure to File Penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late. The penalty won't exceed 25% of your unpaid taxes.

How long can you go without filing taxes?

The IRS expects every business to file a federal tax return and pay taxes every year. So the real answer to that question is (drumroll please): Zero. There are no IRS-issued guidelines or allowances that will let you skip filing taxes for a year.

Can I File My taxes by Myself?

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. It's safe, easy and no cost to you for a federal return.

Can first time filers file electronically?

Yes, you can file an original Form 1040 series tax return electronically using any filing status.

Will I get a bigger tax refund in 2023?

“Refunds may be smaller in 2023,” the IRS said in a November news release. “Taxpayers will not receive an additional stimulus payment with a 2023 tax refund because there were no economic impact payments for 2022.”

When can you file taxes for 2022 in 2023?

January 17: Due date for tax year 2022 fourth quarter estimated tax payment. January 23: IRS begins 2023 tax season and starts accepting and processing individual 2022 tax returns.

When can I expect my tax refund 2022?

Overall, the IRS anticipates most taxpayers will receive their refund within 21 days of when they file electronically if they choose direct deposit and there are no issues with their tax return. The IRS urges taxpayers and tax professionals to file electronically.

How do I file my taxes individually?

Step 1: Calculation of Income and Tax. Step 2: Tax Deducted at Source (TDS) Certificates and Form 26AS. Step 3: Choose the right Income Tax Form. Step 4: Download ITR utility from Income Tax Portal. Step 5: Fill in your details in the Downloaded File. Step 6: Validate the Information Entered.

When should I do my first taxes?

You can prepare and submit your return as soon as you receive your W-2s from your employers and have all the relevant information and documents. Most W-2s arrive in mid-January, but employers have until January 31, 2023 to send 2022 W-2s and Forms 1099, so you could receive yours as late as early February.

How does IRS know if you don't file taxes?

You'll receive a summons from the IRS Just because you didn't tell the IRS you earned money in the past year doesn't mean that your employer didn't! If you do receive a summons, it'll be a part of the IRS collection process — that means that the IRS believes you do, in fact, owe taxes.

When should I expect my tax refund?

When to Expect Your Refund. Refunds are generally issued within 21 days of when you electronically filed your tax return or longer if you filed a paper return. Find out why your refund may be delayed or may not be the amount you expected.

Is it OK if I don't file my taxes?

If you fail to file your taxes on time, you'll likely encounter what's called a Failure to File Penalty. The penalty for failing to file represents 5% of your unpaid tax liability for each month your return is late, up to 25% of your total unpaid taxes. If you're due a refund, there's no penalty for failure to file.

How do I track my ITR refund?

Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue. Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

How much is child tax Credit 2023?

How much is CTC in 2023? Unfortunately, the CTC awarded per child will not be increased in 2023 meaning that the maximum amount one can claim per qualifying child is 2,000 dollars with up to 1,540 dollars being refundable.

Can I do tax return myself?

Lodge online with myTax You can lodge your return using myTax, the ATO's free online tax return. You need a myGov account linked to the ATO to lodge online. Returns lodged this way are usually processed within two weeks. Lodging with myTax is easy and free.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 8633 to be eSigned by others?

Once your IRS 8633 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for the IRS 8633 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your IRS 8633.

How do I edit IRS 8633 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing IRS 8633 right away.

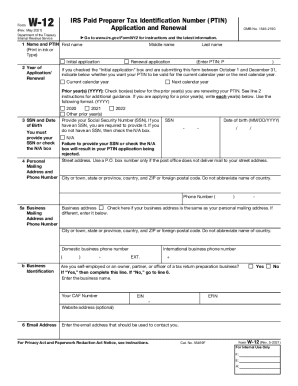

What is IRS 8633?

IRS Form 8633 is an application used by entities to apply for a Preparer Tax Identification Number (PTIN) and to register as a tax professional.

Who is required to file IRS 8633?

Individuals who prepare tax returns for compensation and require a PTIN must file IRS 8633.

How to fill out IRS 8633?

To fill out IRS 8633, you need to complete all required fields with accurate personal and business information, include your signature, and submit the form to the IRS.

What is the purpose of IRS 8633?

The purpose of IRS 8633 is to provide a standardized method for tax professionals to apply for a PTIN, ensuring compliance with IRS regulations.

What information must be reported on IRS 8633?

Information that must be reported on IRS 8633 includes the applicant's name, address, Social Security number, business information, and any previous PTINs, if applicable.

Fill out your IRS 8633 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8633 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.